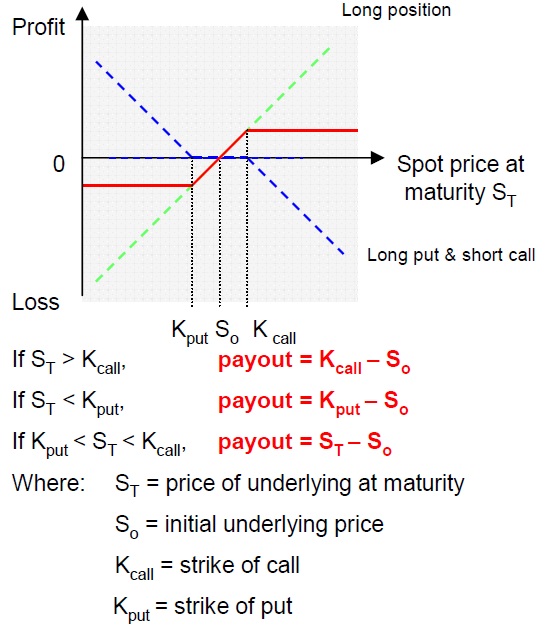

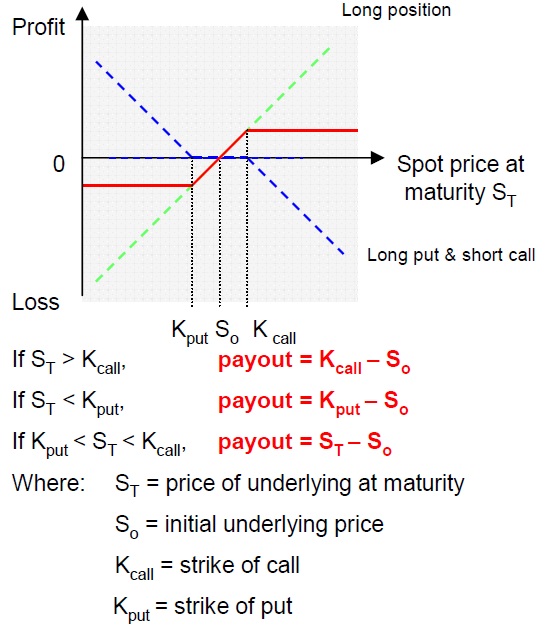

41+ Collar Option Payoff Graph

Collar Option Payoff Graph. Think about of it as a covered call coupled with a long put. This graph indicates profit and loss at expiration, respective to the stock value when you sold the call and bought the put.

It is suited to investors who already own the stock and are looking to: Long stock (at least 100 shares) sell call option to finance the purchase of the protective put Sure, here's a payoff graph of a $35 call option with 60 days to maturity, 25% volatility, 0% dividend yield, 8% interest rate and an underlying price of $40.

converter video youtube para mp3 coiffure carre mi long destructure coiffure courte coupe de cheveux femme 50 ans avec lunettes clin douglas castorama

Zero cost collar on existing long position The Financial

Download the options strategy payoff calculator excel sheet from the end of this post and open it. Mighaugust 24th, 2012 at 3:06am. The payoff graph will show you the variation of profit as the price of the underlying changes. This microsoft excel spreadsheet is intended to illustrate payoff and profit diagrams for option contracts.

Buying the put gives you the right to sell the stock at strike price a. If you are interested in this particular option payoff calculator excel, you can download it here, along with out options. Sure, here's a payoff graph of a $35 call option with 60 days to maturity, 25% volatility, 0% dividend yield, 8% interest rate and an.

Calls and puts an option is a derivative contract that gives the holder the right, but not the obligation, to buy or sell an asset by a certain date at a specified price. 5 paisa ₹0 account opening. This basic option trading calculator excel is the one we use when we want to open simple strategies such as a covered.